Prospect portfolios are crucial for any organization that wants to stay on top of identifying potential major donors who could make a difference at their organization. Knowing that prospect portfolios are important is easy, but what’s not as easy is actually effectively managing a prospect portfolio. To help you effectively make the most of a prospect portfolio, we’ll cover:

- What is a Prospect Portfolio?

- Why is Fundraising Portfolio Management Important?

- Prospect Management Best Practices – 3 Steps for Year-Over-Year Success

Our three-step strategy can help you improve your current prospect portfolio management, or even take you from having no prospect portfolio at all to cultivating a portfolio with successful year-over-year management. Here is what you need to know for a successful portfolio management strategy.

What Is a Prospect Portfolio?

Prospect portfolios are a method of organizing your institution’s donors and prospects to ensure that each one has an assigned gift officer who is moving the relationship towards the next giving level. They are sometimes also called “fundraising portfolios.” Essentially, prospect portfolios are a centralized place for collecting data about your donors to help you identify which prospects should be prioritized. You can have standard prospect portfolios for all levels of donors as well as specialized portfolios for annual giving and major gifts.

While you are likely already making efforts to deepen donor relationships, solicit more donations, and close major gifts, a robust prospect portfolio can help you do so more efficiently. Having information about their giving history and capacity to give allows you to strategically focus on prospective donors who have the highest likelihood of making a gift, ensuring you are making the best use of your time and resources.

Why Is Fundraising Portfolio Management Important?

Knowing how to properly build and maintain a prospect portfolio year-over-year is crucial for long-term success. Whether you are starting from scratch or looking to refine an existing program, the three-step strategy outlined below will help you cultivate the best fundraising prospects, empowering you to close more gifts in less time.

Prospect Portfolio Management Best Practices – 3 Steps for Year-Over-Year Success

Step 1: Establish a portfolio of prospects

An organization’s top prospects are typically those who have both the capacity and a strong inclination to give. However, the tricky part is figuring out which prospective donors fall into that category. So, how do we determine capacity and inclination? We rely on data and anecdotal information.

The following information can help you learn more about your donors’ capacity and inclination to give:

- Prospect ID

- Name

- Address

- Number of years of giving

- Number of gifts

- Lifetime giving amount

- Capacity (wealth screening score or in-house rating)

- Last gift date

- Last gift amount

- Largest gift amount.

- Largest gift date

While there are innumerable data points to evaluate, gathering these will help you formulate a basic donor profile. This donor profile can include giving history data points from the list above, like their number of years as a donor, the number of gifts, largest gift, cumulative amount gifted to your organization, giving frequency, and giving recency.

Combining these data points with a capacity rating creates a data-driven analysis of a donor’s capacity and inclination. But that isn’t the whole story. It is critical to consider any anecdotal information you have about your prospects.

To flesh out your data analysis, refer to colleagues with institutional knowledge, volunteers who know the prospect, and contact reports — which are written following gift officer interactions with the prospect.

For instance, does a contact report from a meeting with Mr. Smith indicate that your organization is among his top philanthropic priorities? If so, you have a sign of high giving inclination. Alternatively, did Mrs. Jones tell a gift officer in 2015 that she wanted to be removed from all solicitations and call lists? Regardless of her capacity, she is not inclined to support the organization and should not be assigned to a portfolio.

Once you have a comprehensive list of viable prospects, they can be divided up into gift officer portfolios. Portfolios can range in size from 25–200 prospects depending on how much time the development officer spends on donor stewardship.

Step 2: Begin managing your fundraising portfolio

Once your portfolio is established, the next step is to create a system to use and maintain it. You can begin by prioritizing prospects, initiating engagements, and evaluating your progress for future improvement:

- Prioritize prospects within your portfolio. As a gift officer assigned a portfolio, there are a number of steps you can take to effectively manage your prospect list. First, prioritize prospects within your portfolio by sorting and filtering relevant data. Use data such as donor history, giving frequency, and giving recency to prioritize prospects within your portfolio.

- Set an individualized engagement strategy. Next, combine your data with anecdotal evidence to create an individualized engagement strategy for each prospect. When possible, identify a target solicitation amount and date to help you prioritize your prospects. For instance, do you have any updates to share on an initiative a donor previously supported? Is there an upcoming event to which you’d like to extend a personal invitation? Which current fundraising priorities align with their noted interests? Once you’ve established your strategy, create a next action step: email an update; send an invitation; request a meeting.

- Evaluate your activity and progress. As you work your way through your portfolio, evaluate your progress on a monthly basis. Are you executing and updating your next step actions? How many unique outreaches are you making per month? How many meetings are you completing? How many solicitations? How many gifts are closed? How many disqualifications?

Evaluating your progress ensures you improve your major donor cultivation efforts each year. To make sure you’re not missing any important markers of success or areas for improvement, here are more tips on evaluating gift officer impact and success.

Step 3: Follow best practices for year-over-year prospect portfolio management

At the start, your fundraising portfolio management process will likely require more oversight and adjustments as you learn what works best for your organization. However, there are a few best practices that all organizations should follow, regardless of how far along in the process they are.

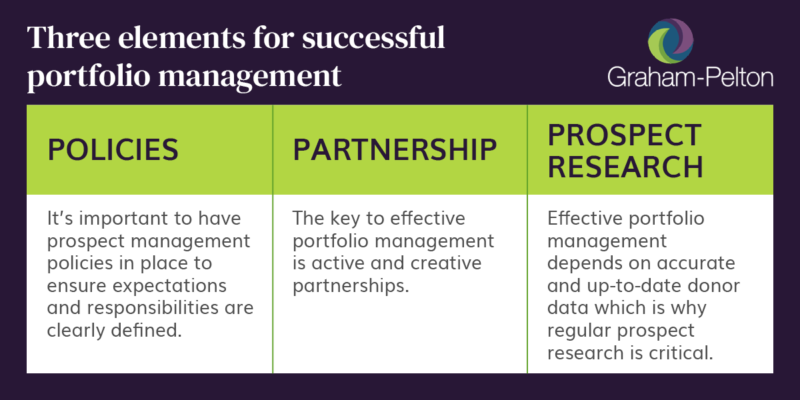

Policies

For organizations with multiple gift officers, it is particularly important to have prospect management policies in place to clearly define expectations and responsibilities and avoid repeating previous engagement efforts. Some examples of prospect management policies include:

- Criteria for assigning and disqualifying prospects from portfolios

- Protocol for moving prospects between gift officer portfolios (i.e., moving a prospect from an annual giving portfolio to a major gift portfolio)

- Clear gift crediting policies that encourage collaboration

Having clear-cut guidelines right from the start will help you avoid sticky situations and allow you to focus on improving efficacy.

Partnership

The key to effective portfolio management is active and creative partnerships. This can mean working across teams, with different team members, or bringing different tools together. Partnerships may vary depending on the size of your organization. For example, planned giving officers, annual giving officers, researchers, and development or organizational leaders may be helpful partners for strategy development and cultivation (or solicitation) activities.

Thinking about partnerships in a different way, an often overlooked partner is your organization’s CRM, especially when development colleagues across your organization partner to keep the records up to date. In this case, using your CRM to facilitate partnership between major gift officers and having a standardized way of using it can be extremely helpful.

Prospect Research

Effective portfolio management depends on accurate and up-to-date donor data and information. That’s why timely reporting and regular prospect research are critical.

Research teams should establish a year-round process for screening and rating new donors to create a pipeline of prospects for gift officer portfolios. For smaller organizations that may not have a dedicated research team, setting up Google Alerts for top prospects or training gift officers (or another staff member) in research and prospecting basics is a worthwhile investment. Setting aside just a few hours a week to look at top prospects or vet new donors is essential for effective portfolio management.

Wrapping Up

With this three-step strategy, you’ll be well-equipped to start or improve your prospect portfolio management process. Remember, the data that you input into your fundraising portfolio is the core of a successful prospect management process and needs to be updated with prospect research and evaluated on a regular basis.

To learn more about nonprofit development best practices, explore these additional resources from the Graham-Pelton team:

- Conducting a Capital Campaign Feasibility Study: 5 Steps. Preparing for a capital campaign? Learn more about this critical early step for gathering stakeholder input.

- Building a Case for Support That Inspires Action: 5 Steps. Motivate more donors and simplify your messaging to increase impact by creating a compelling case for support.

- Why Donor Qualification Is Key to Fundraising Success. Donor qualification should be an integral and ongoing part of your development program.

- Grateful Patient Fundraising: 5 Best Practices for Success. Fundraising for a healthcare institution? Learn the best practices unique to this type of fundraising.

- Employee Retention Strategies for Nonprofits: Complete Guide. Retain your fundraising team by leveraging the best strategies.